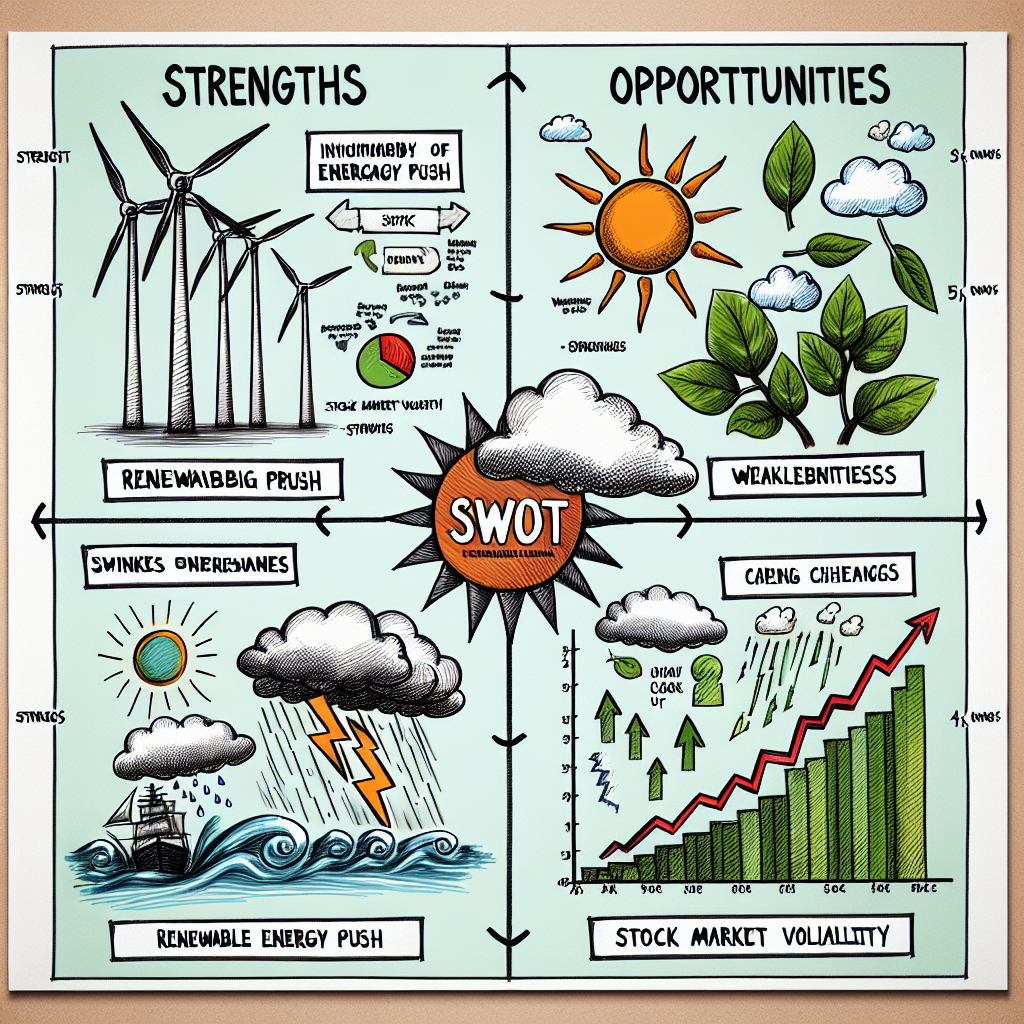

AES’s renewable energy push is facing challenges due to stock volatility, according to a recent SWOT analysis. The company’s efforts to transition to renewable sources of energy have been met with headwinds, as its stock has been fluctuating.

The analysis highlights the strengths, weaknesses, opportunities, and threats that AES is currently facing in its renewable energy endeavors. While the company has made significant progress in its renewable energy projects, its stock performance has been a cause for concern.

On the positive side, AES has a strong track record in the energy industry and has successfully implemented renewable energy projects in the past. The company’s commitment to sustainability and reducing its carbon footprint has also been well-received by investors and customers.

However, the analysis also points out some weaknesses that AES needs to address. One of the main challenges is the volatility of its stock, which can impact the company’s ability to secure funding for its renewable energy projects. This is especially relevant as the company plans to invest $2.5 billion in renewable energy projects over the next three years.

In terms of opportunities, AES has a significant potential for growth in the renewable energy market. With the increasing demand for clean energy and the global shift towards sustainable practices, the company is well-positioned to capitalize on this trend.

However, there are also threats that AES needs to consider. The volatility of the stock market, as well as the uncertainty surrounding government policies and regulations, can pose challenges for the company’s renewable energy plans. Additionally, competition from other renewable energy companies can also impact AES’s market share.

The context of this news story is important as it sheds light on the current state of AES’s renewable energy efforts. The company’s push towards renewable energy is commendable, but the challenges it is facing highlight the complexities of transitioning to clean energy sources.

The potential impact of this news story is significant as it can affect AES’s stock performance and its ability to secure funding for its renewable energy projects. It also highlights the need for companies to carefully consider the risks and challenges involved in transitioning to renewable energy sources.

In conclusion, AES’s SWOT analysis reveals the company’s strengths, weaknesses, opportunities, and threats in its renewable energy push. While the company has made progress in