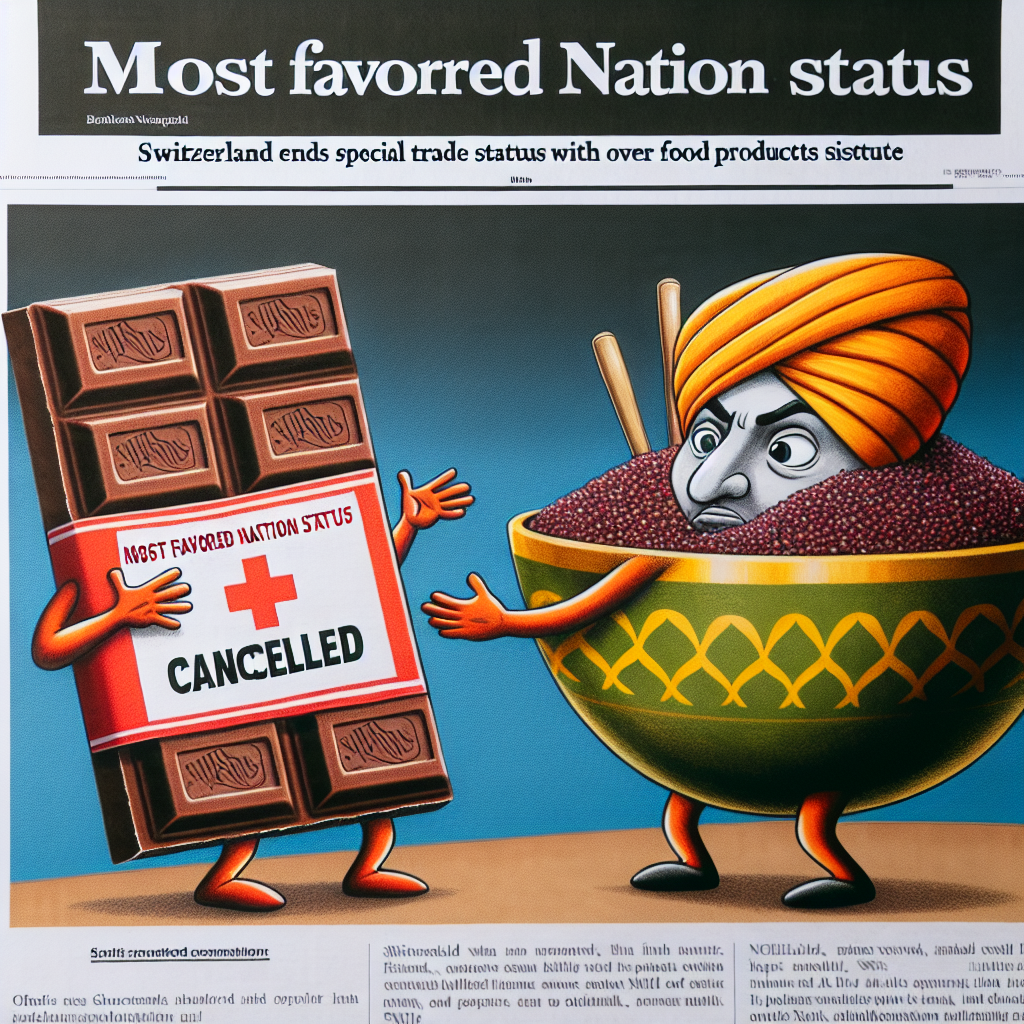

The Swiss government has suspended the most favoured nation status (MFN) clause in the Double Taxation Avoidance Agreement (DTAA) between India and Switzerland, potentially impacting Swiss investments in India and leading to higher taxes on Indian companies operating in the European nation. This move comes after the Supreme Court of India last year ruled that the MFN clause does not automatically trigger when a country joins the OECD if the Indian government signed a tax treaty with that country before it joined the organization. This decision by the Swiss government could have significant implications for Indian entities operating in Switzerland, as it could result in increased tax liabilities.

The MFN clause in the India-Switzerland DTAA allows for the application of lower tax rates on certain types of income if India provides those rates to other countries under a tax treaty. However, the Swiss government has now suspended the application of this clause, citing a 2023 ruling by the Indian Supreme Court in a case involving Nestle. The court ruled that the MFN clause was not directly applicable in the absence of notification in accordance with Section 90 of the Income Tax Act. This means that from January 1, 2025, Switzerland will levy a 10 per cent tax on dividends due to Indian tax residents who claim refunds for Swiss withholding tax and for Swiss tax residents who claim foreign tax credits.

This decision by the Swiss government highlights the complexities of navigating international tax treaties in an evolving global landscape. It also underscores the necessity of aligning treaty partners on the interpretation and application of tax treaty clauses to ensure predictability, equity, and stability in international tax frameworks. The suspension of the MFN clause could potentially lead to higher taxes for Indian entities operating in Switzerland, which could impact their profitability and competitiveness. It remains to be seen how this decision will affect the bilateral trade and investment relationship between India and Switzerland in the long run.